owner's draw vs salary

By Toni Cameron On October 17 2019 February 4 2022. Owners Draw Taxes.

Quickbooks For Contractors Tip Basics Of Progress Invoicing Quickbooks For Contractors Blog

If an individual invests 30000 into a business entity and their share of profit is 18000 then their owners equity is at 48000.

. The business owner takes funds out of the business for personal use. When choosing owners draw. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

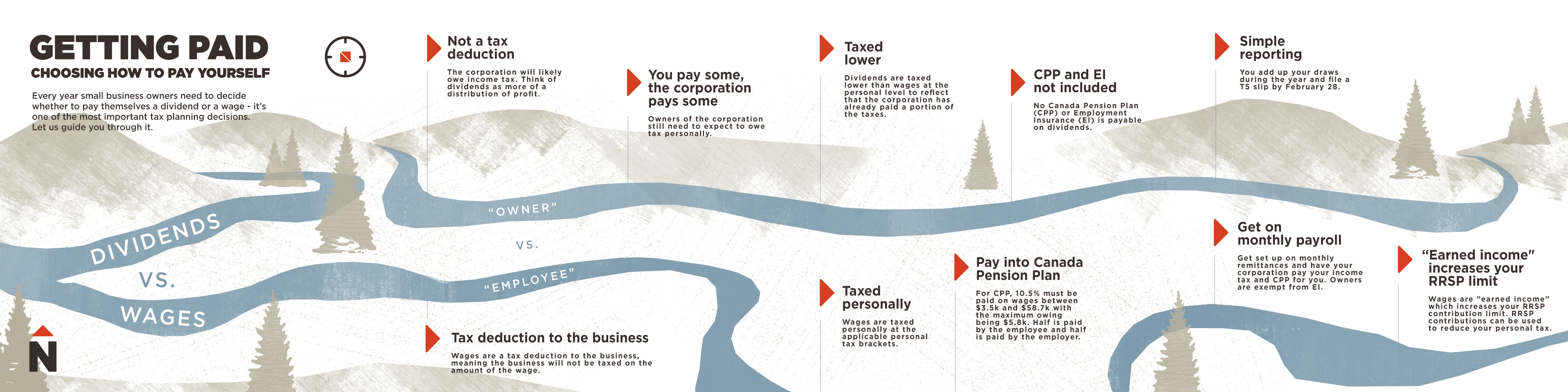

If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees salaries fabric costs and other various expenses. If you pay yourself a salary like any other employee all federal state Social Security and Medicare taxes will be automatically taken out of your paycheck. A salary is less flexible but it already deducts taxes and its a stable recurring expense to.

Because your company is paying half of your Social Security and Medicare taxes youll only pay 765 half what youll pay if you take an owners draw. Are infrequent in nature. 70000 contributions 30000 share of profits - 15000 owners draw 85000.

Your own equity in the business is at 60000. So if she chose to draw 40000 her owners equity would now be. The owners draw is the distribution of funds from your equity account.

In the latter method you take a salary just as any other employee. Also you cannot deduct the owners draw as a business expense unlike salary. However anytime you take a draw you reduce the value of your business by the amount you take out.

If youre not interested in the bonus route you can always adjust your salary each year based on how your company is performing. So if your company grew by 50 in the past year and your current salary is 70000 youd multiply your salary by 150 and come up with your new salary which is 105000 not bad. So if you are a sole proprietor a partner or an LLC you can go for the owners draw.

Suppose the owner draws 20000 then the owners equity is reduced to 28000. Draws can happen at regular intervals or when needed. Also you can deduct your pay from business profits as an expense which lowers your tax burden.

Its the amount an owner invested and profits that the business made thanks to the investment. This leads to a reduction in your total share in the business. She could choose to take some or even all of her 80000 owners equity balance out of the business and the draw amount would reduce her equity balance.

Is it a draw or a salary. One of the main differences between paying yourself a salary and taking an owners draw is the tax implications. Lets say our friend Charlie decides to pay himself on a payroll salary.

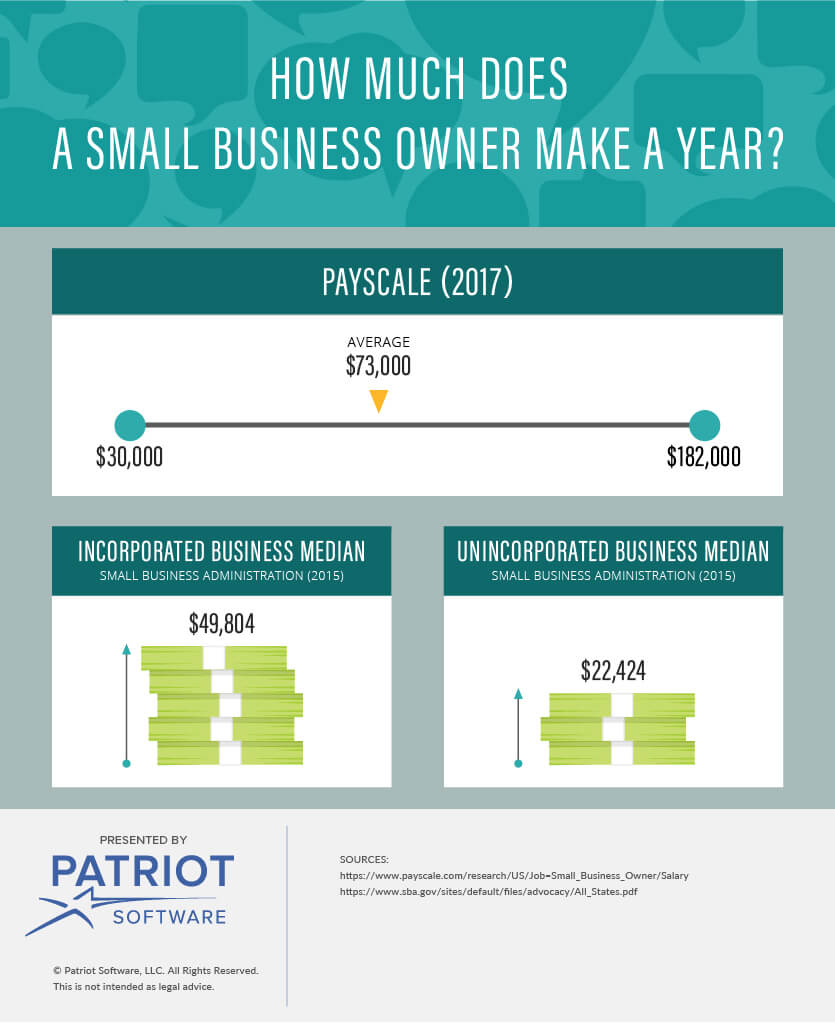

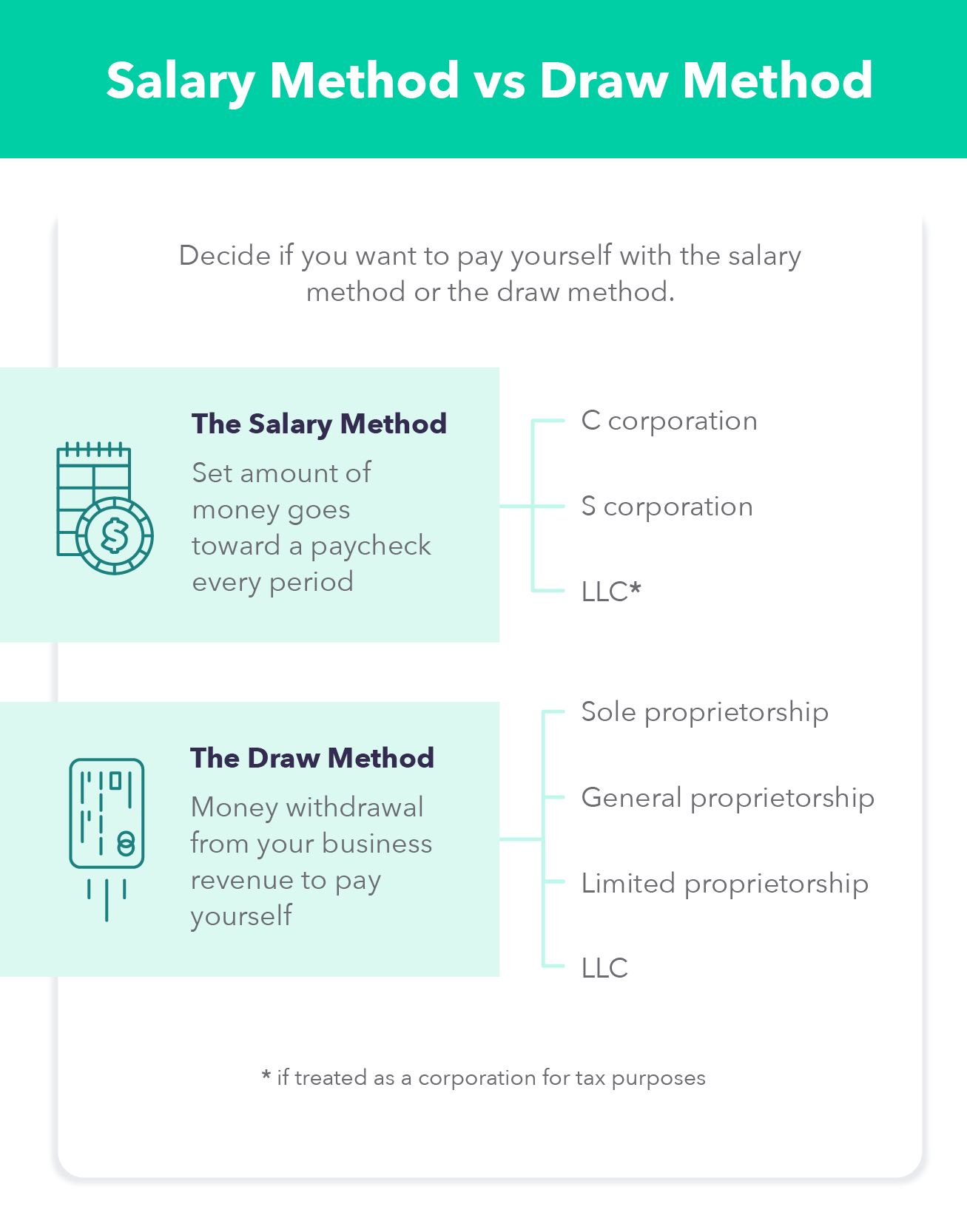

The business owner determines a set wage or amount of money for themselves. Generally the salary option is recommended for the owners of C corps and S corps while taking an owners draw is usually a better option for LLC owners sole proprietorships and partnerships. There are two main ways to pay yourself as a business owner owners draw and salary.

This is because the owners. Your two payment options are the owners draw method and the salary method. Patty can choose to take an owners draw at any time.

In the former you draw money from your business as and when you see fit. An owners draw is very flexible. Here is her partner equity balance after these transactions.

Owners draws can be scheduled at regular intervals or taken only when needed. However it can reduce the businesss equity and available funds and you must account for self-employment taxes. Taking Money Out of an S-Corp.

As the owner you can choose to take a draw if your personal equity in the business is more than the businesss liabilities. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

Taking Money Out of an S-Corp. You dont need a salary because you have the flexibility to increase and decrease your draw depending upon your wants and needs. Therefore you can afford to take an owners draw for 40000 this year.

Heres a high-level look at the difference between a salary and an owners draw or simply a draw. On the other hand a payroll salary offers more stability and less planning at the expense of less flexibility. Are usually either for estimated taxes due to a specific event or from business growth.

Stephen L Nelson S Small Business Tax Deduction Secrets Ebook Tactics And Tricks F Small Business Tax Deductions Business Tax Deductions Small Business Tax

How To Pay Yourself Dividends Vs Wages Olympia Benefits

How To Pay Yourself Dividends Vs Wages Olympia Benefits

Are You New To Tracking Reviewing And Reporting Your Business S Finances Find Out How To Set Up Accounting B Accounting Books Accounting Accounting Training

Salary Vs Draw How To Pay Yourself As A Small Business Owner

Product Manager Vs Product Owner Vs Project Manager Teamhood

Credit Mentor On Instagram Goodmorning Y All Ion Know About Yall But Ima Risk Taker I Refuse To Be Average Or Below Viral Art Fitness Lifestyle Photo

Also Interesting Men Vs Women Man Vs Infographic

Owner S Draw Vs Salary How To Pay Yourself Bench Accounting

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

Entrepreneur Salary 5 Steps To Paying Yourself First Mintlife Blog

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

Salary Or Draw How To Pay Yourself As A Business Owner Or Llc Quickbooks Brasil

Owner Draw Vs Salary Paying Yourself As An Employer

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

Easy Monthly Budget Template Wendy Valencia Monthly Budget Template Budget Template Saving Money Quotes